Payroll and timekeeping processes are crucial components of human resource management. These processes require high accuracy in recording work hours and paying employees. An effective payroll and timekeeping process helps businesses maintain employee satisfaction, comply with legal regulations, and optimize work efficiency. To gain an overview of this process and find ways to manage it effectively, the following article will address your concerns.

Nội dung

1. Why Are Payroll and Timekeeping Processes Important?

1.1 Ensuring Employee Satisfaction

Compensation is one of the most critical factors affecting employee satisfaction and loyalty to a company. When payroll and timekeeping are carried out accurately, employees feel respected and assured of fairness in the company’s employment practices. This helps minimize complaints and disputes related to compensation while creating a positive and productive work environment.

1.2 Optimizing Resources

Developing an efficient payroll and timekeeping process saves time for the HR department, reduces errors, and optimizes resources. This allows businesses to focus on other core activities such as product development, services, and customer care.

1.3 Legal Compliance

Payroll and timekeeping are directly linked to labor laws, social insurance, and taxes. Ensuring that these processes are carried out correctly not only helps businesses avoid legal risks but also contributes to building the organization’s reputation and social responsibility.

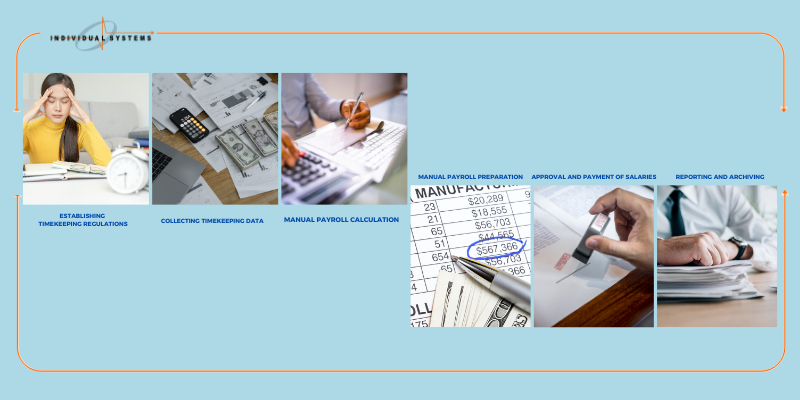

2. Manual payroll and timekeeping process

2.1 Establishing Timekeeping Regulations

- Companies need to set standards for working hours, overtime, breaks, and various types of leave, which should be communicated to all employees.

- Use methods such as logbooks, paper time cards, or Excel-based timesheets.

- Employees can manually record their in and out times daily, or a designated person can manage a common timesheet.

2.2 Collecting Timekeeping Data

- Employees or direct managers record working hours, breaks, and types of leave in a logbook or timesheet, which is compiled at the end of the month or payroll period.

- The manager or HR department checks the logbook or timesheet to verify accuracy and correct any errors if necessary.

2.3 Manual Payroll Calculation

- Calculating Working Hours:

- Calculate the total working hours, overtime, and leave hours for each employee based on timekeeping data.

- For employees who work overtime, determine the exact overtime pay rate for accurate calculation.

- Payroll Calculation:

- Based on the total working hours and payroll policies regarding basic salary, allowances, bonuses, and deductions (insurance, taxes), calculate each employee’s salary.

- This can be done manually or using Excel spreadsheets.

2.4 Manual Payroll Preparation

- After calculating salaries, the company needs to prepare detailed payrolls, listing salaries, allowances, bonuses, deductions, and the net amount for each employee.

- This payroll is usually prepared on paper or Excel.

- The manager or HR department should carefully review the payroll to ensure no errors before approval.

2.5 Approval and Payment of Salaries

- After review, the payroll needs to be approved by authorized management before payment. This typically includes verifying the payroll.

- Salaries are paid to employees in cash or via bank transfer, depending on the company’s policies.

- When making payments, companies must retain receipts and documentation as proof of payment.

2.6 Reporting and Archiving

Preparing Payroll Reports:

- Companies need to compile comprehensive payroll reports to control finances and manage human resources at the end of the month or payroll period.

- Timekeeping logs, payrolls, and payment receipts must be securely stored for future auditing or reference.

- This storage can be on paper or as Excel files.

Although some companies still use manual payroll and timekeeping processes, these have many drawbacks, including being time-consuming, labor-intensive, and prone to errors due to manual data entry. In companies with many departments or branches, this can lead to a lack of transparency and consistency, making long-term data integration and storage difficult, and hindering legal compliance and work efficiency. These limitations can result in payroll mistakes, employee dissatisfaction, and reduced business performance.

3. Accurate and Efficient Payroll and Timekeeping with IVS’s IHRM Software

To eliminate the drawbacks of manual payroll and timekeeping processes, IVS’s IHRM software has been developed to thoroughly address the challenges businesses face in payroll and timekeeping. This software offers high efficiency and accuracy.

3.1 Setting Up the Timekeeping System

Before starting the timekeeping process, companies need to establish regulations related to working hours, leave, and other types of work activities on the IHRM system. IHRM allows for detailed and flexible setup of these regulations, including:

- Work time setup: Define shifts, start and end times, lunch breaks, and shift breaks.

- Timekeeping method setup: Choose timekeeping methods such as fingerprint, magnetic card, or mobile application to suit the business’s needs and capabilities.

- Leave management: Create policies for leave, sick leave, and maternity leave, and easily manage employees’ remaining leave days.

3.2 Managing Timekeeping Data

After setting up the system, timekeeping data is automatically collected and stored on the IHRM system. Companies can monitor actual working hours and easily manage timekeeping issues:

- Automated data collection: The system automatically records employee in and out times from linked timekeeping devices.

- Data verification and adjustment: In case of errors, employees or managers can request adjustments to the timekeeping data, ensuring accuracy and transparency.

- Timekeeping reports: IHRM provides detailed timekeeping reports, allowing management to easily track working hours, leave time, and other related data.

3.3 Automatic Payroll Calculation

Based on the collected timekeeping data, IHRM software automatically calculates employee salaries. This process includes calculating basic salaries, allowances, bonuses, as well as deductions like social insurance and personal income tax:

- Salary calculation formula setup: Companies can set up salary formulas that match their compensation policies, including hourly wages, monthly salaries, night shift allowances, overtime pay, etc.

- Automatic salary calculation: The system automatically performs complex calculations and generates detailed payrolls for each employee.

- Payroll creation: The generated payroll includes complete information on earnings, allowances, deductions, and net income.

3.4 Payroll Review and Approval

After calculations, the payroll must be reviewed and approved before payment. IHRM provides an intuitive interface that makes it easy for managers to review details and make adjustments if needed:

- Salary detail review: Managers can review payroll items to ensure that all information is accurate and error-free.

- Payroll approval: After review, managers can approve the payroll and prepare for payment.

3.5 Salary Payment

Once the payroll is approved, the company can proceed with salary payments to employees. IHRM supports integration with banking systems, making the transfer process quick and convenient:

- Bank integration: IHRM allows connections with various banks, enabling salary payments to be made directly from the software.

- Payment history storage: The system stores detailed payment history, allowing businesses to track and verify transactions as needed.

3.6 Reporting and Data Storage

The IHRM system provides comprehensive reports on payroll, bonuses, workdays, and other customizable reports. Report results are updated in real time and stored accurately within the system. Managers can easily retrieve information and promptly grasp the situation, leading to effective decision-making.

With its accuracy, efficiency, and security, IVS’s IHRM system addresses all the shortcomings of manual timekeeping and payroll processes. By applying technology to improve the management system, many businesses have operated more efficiently and enhanced their competitiveness in the market.

4. Conclusion

Businesses strive to ensure sustainable development by using accurate timekeeping and payroll. Hopefully, this article will help managers find suitable solutions to address their time-keeping and payroll process challenges.